How does Connex Desktop refunds affect QuickBooks reports

An A/R and an income account are affected

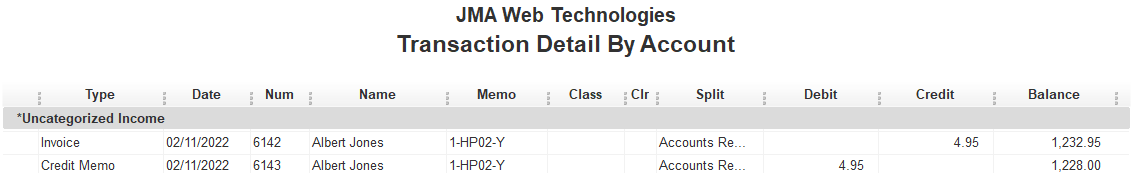

How are income accounts affected?

Refunds in QuickBooks offset an A/R account. A refund will debit the income account and a sale will credit it.

In this example, an invoice has a product called 1-HO02-Y. The product has an income account called Uncategorized Income. The invoice is created, then the credit memo cancels the invoice:

Can I place refunds into a separate income account?

Create a product in QuickBooks with the desired income account. Use our rules engine to change the SKU for refunds. For more info, read this guide. The guide works with QuickBooks Online and Desktop.

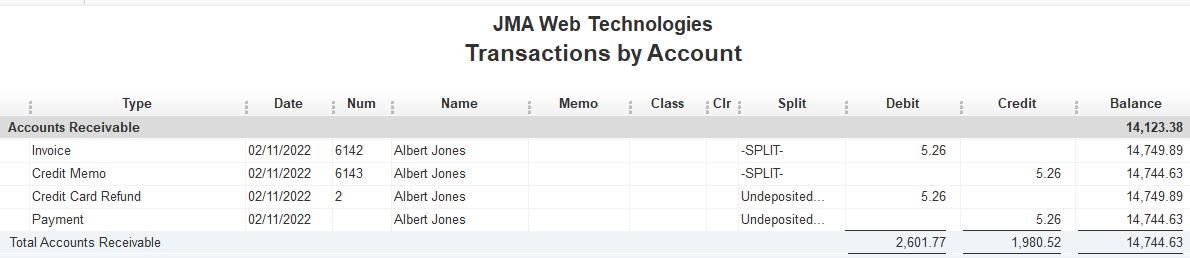

How is A/R affected?

In this example, a invoice and payment are created. Connex created a credit memo and a credit card refund:

Can I use a different A/R accounts for refunds?

You must use the same A/R account for refund and credit memos. Otherwise, the invoice will appear open.

![Connex_Logo_HelpCenter_100h.png]](https://help.connexecommerce.com/hs-fs/hubfs/Connex_Logo_HelpCenter_100h.png?height=50&name=Connex_Logo_HelpCenter_100h.png)