How should I handle gift cards in QuickBooks Desktop?

E-Commerce businesses frequently sell gift cards. This article is about how to ensure your sync works when you sell a gift card and your customer pays using a gift card.

Introduction

- When you sell a gift card it is not considered income until you have provided the product or service that the gift card redeems.

- The sale of a gift card it is considered a liability in QuickBooks.

- Once the gift card is redeemed it adds to your income account and removes the gift card from the liability account in QuickBooks.

How does Connex handle gift cards/gift certificates?

If a gift card is purchased, then it will appear as a non-inventory part with a positive dollar amount on the QuickBooks invoice or sales receipt. If the gift card is used as a form of payment, then the gift card appears as a discount when syncing a sales receipt. Non-inventory parts in QuickBooks allow negative amounts.

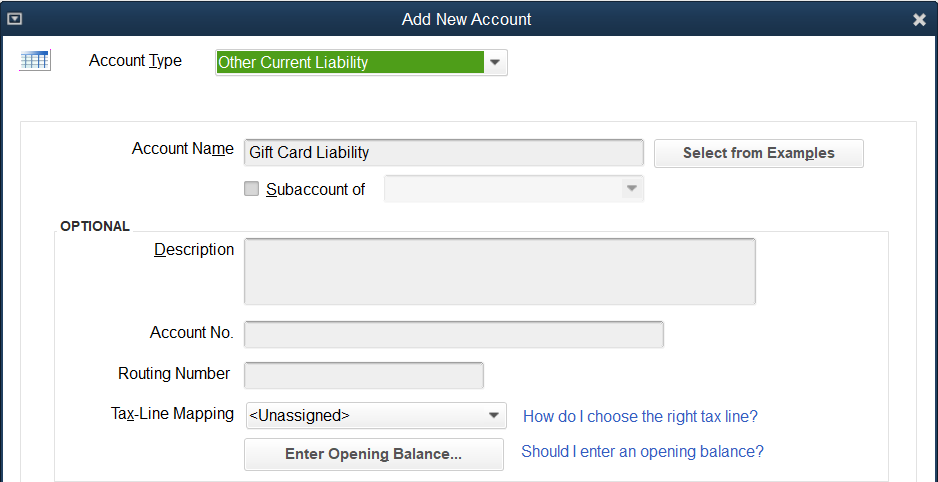

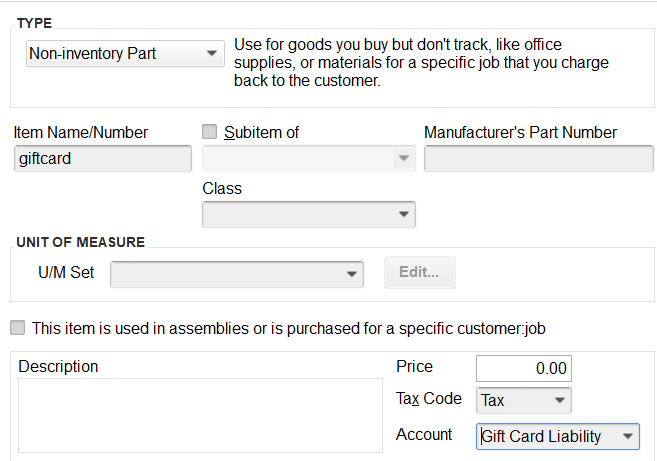

Connex will map all gift cards to an item called giftcard. This item should be of type non-inventory and its income account it set to a liability.

Here is an example from QuickBooks Desktop:

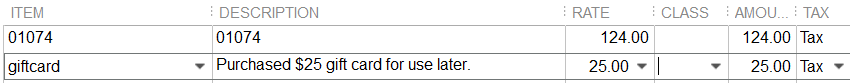

If a user purchases a gift card for later use, how does it look?

The product giftcard will appear as a line item. Here is a $25 purchase:

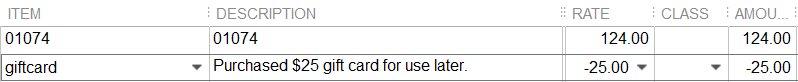

If the user syncs sales receipts and the user pays by gift card, how does it look?

The gift card looks like a discount:

If the user syncs invoices, how does it look?

In this case, the gift card is a payment method on a payment. The payment total equals the gift card total.

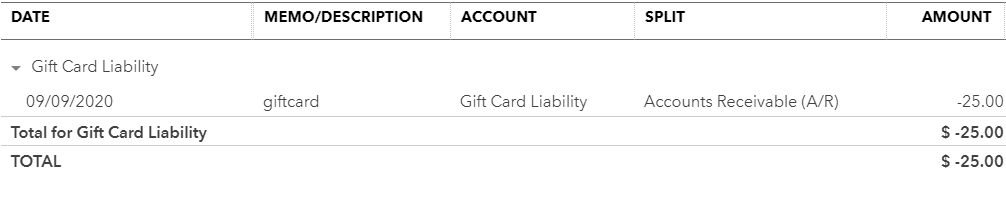

How does it look in my balance sheet?

Here is an example report:

Can't find what you're looking for? Let us help you right now!

Can't find what you're looking for? Let us help you right now!

![Connex_Logo_HelpCenter_100h.png]](https://help.connexecommerce.com/hs-fs/hubfs/Connex_Logo_HelpCenter_100h.png?height=50&name=Connex_Logo_HelpCenter_100h.png)