How should I handle gift cards in QuickBooks Online?

In E-Commerce gift cards are a common practice, here is how Connex handles them.

How do they map?

If gift cards are purchased, then they appear as a non-inventory part with a positive dollar amount. If the gift card is used as a form of payment, then the card appears as a discount on a sales receipt. Non-inventory parts allow negative amounts.

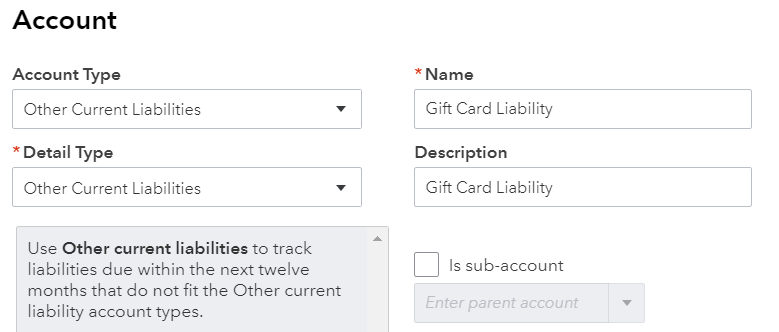

Connex will map all gift cards to an item called giftcard. This item should be of type non-inventory and its income account it set to a liability.

For QuickBooks Online, here is how it should look:

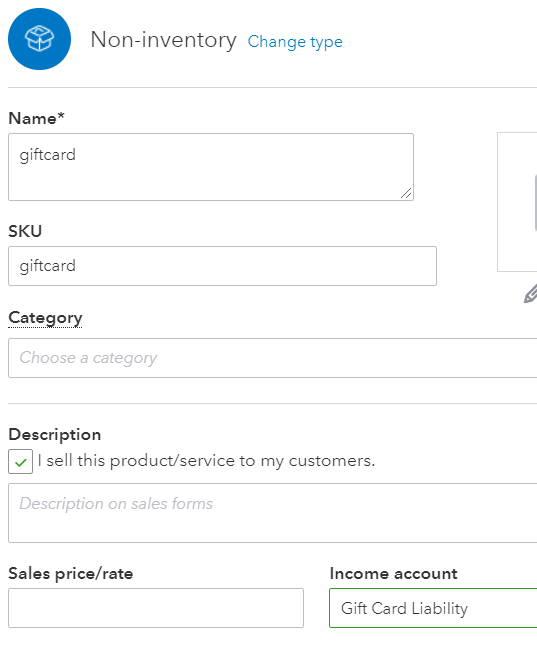

If a user purchases a gift card for later use, how does it look?

The product giftcard will appear as a line item. Here is a $25 purchase:

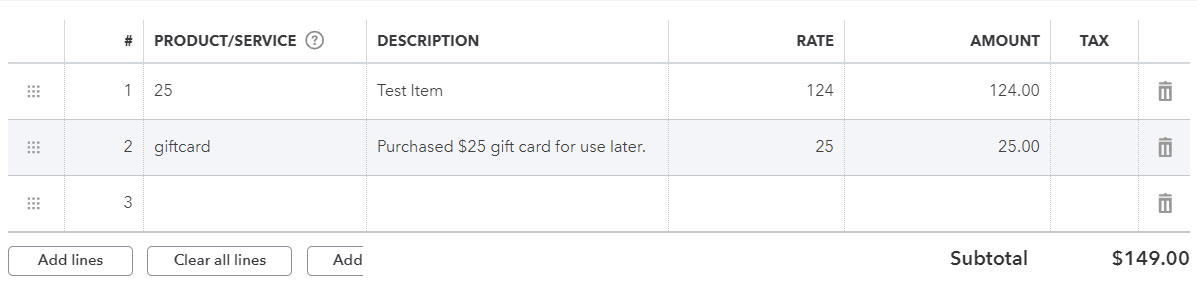

If the user syncs sales receipts and the user pays by gift card, how does it look?

The gift card looks like a discount:

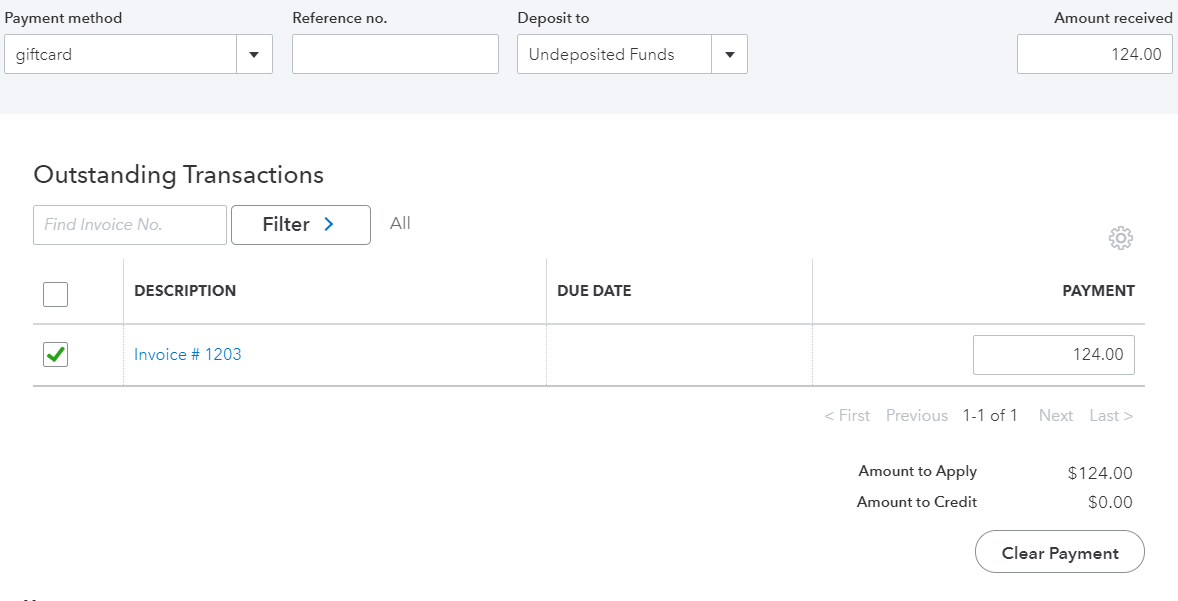

If the user syncs invoices, how does it look?

In this case, the gift card is a payment. Here is a full payment by gift card:

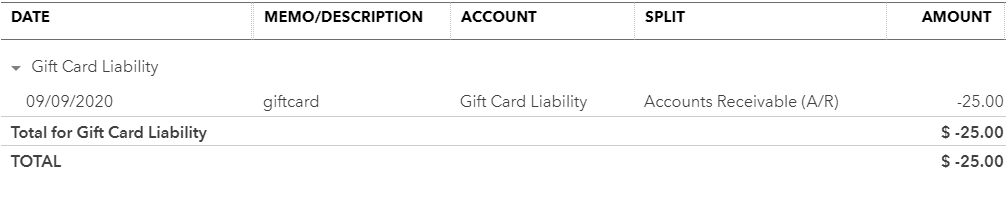

How does it look in my balance sheet?

Here is an example report:

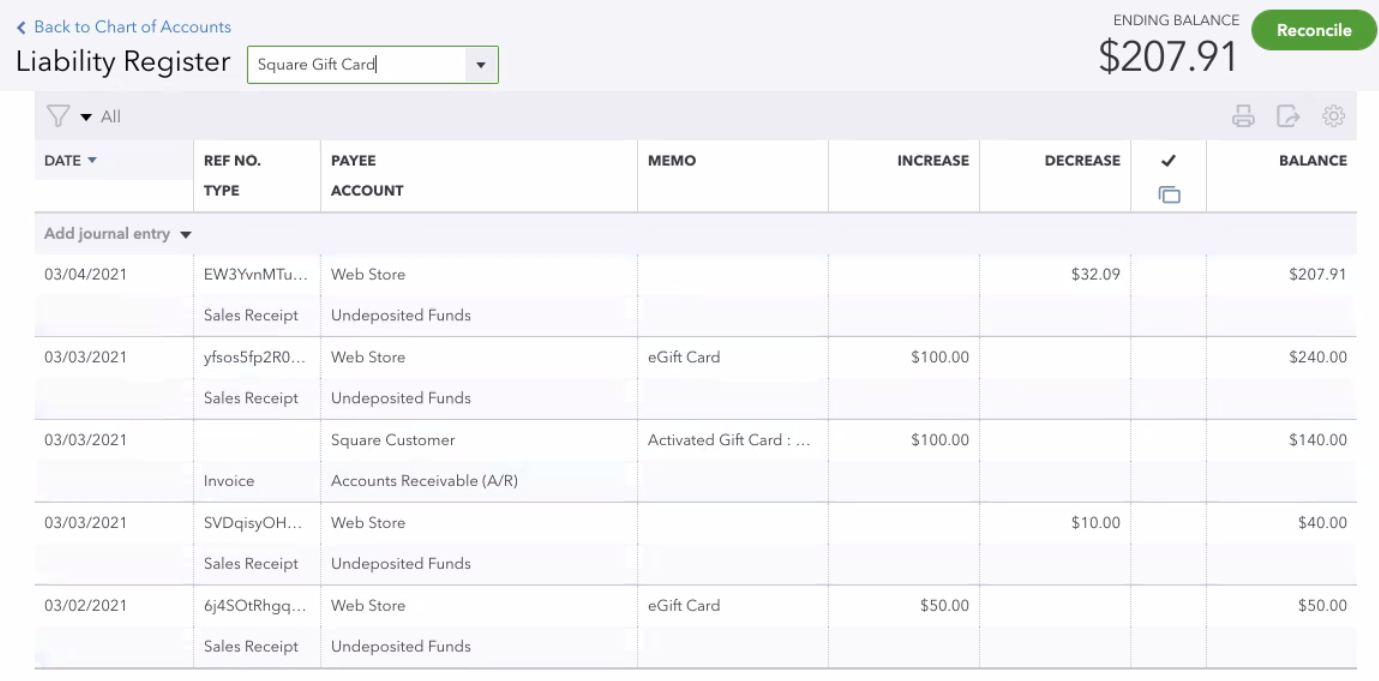

Here is another example of sales and purchases:

Here is another example of sales and purchases:

![Connex_Logo_HelpCenter_100h.png]](https://help.connexecommerce.com/hs-fs/hubfs/Connex_Logo_HelpCenter_100h.png?height=50&name=Connex_Logo_HelpCenter_100h.png)