How do I map sales tax codes to QuickBooks Desktop?

Connex for QuickBooks allows you to match existing QuickBooks tax codes based on the city, county, or state to QuickBooks.

Enable QuickBooks Desktop Sales Tax

If you use QuickBooks Online, then skip this step. To get started, sales tax management must enabled in QuickBooks, even if your company charges does not charge sales tax.

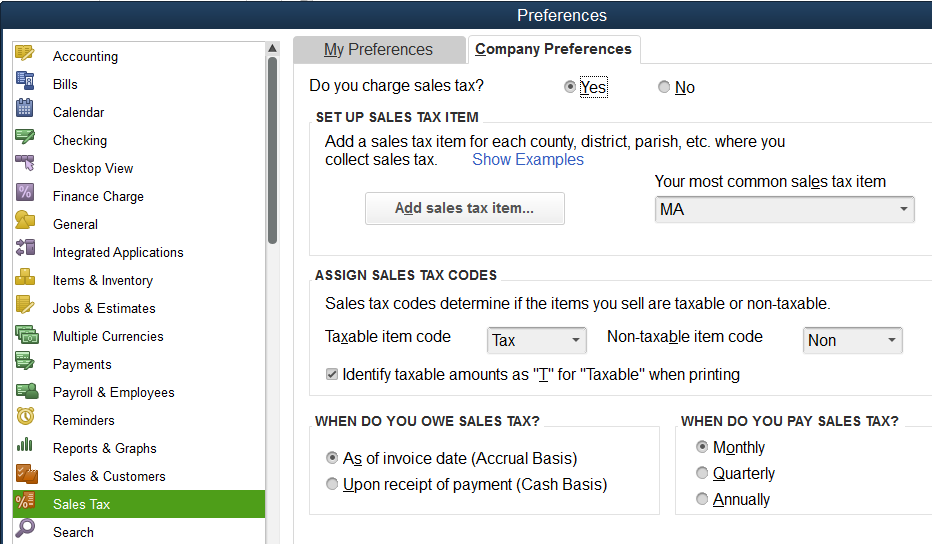

- In QuickBooks, click Edit > Preferences;

- next, click Sales Tax > Company Preferences;

- Click Yes to 'Do you charge sales tax?'.

- Add a default tax agency:

- When asked to make items and customers taxable, click OK.

Map Tax Codes in Connex

Now that we have some tax codes, for U.S. customers, let's map existing QuickBooks sales tax codes:

- Login to Connex.

- Click sales tax.

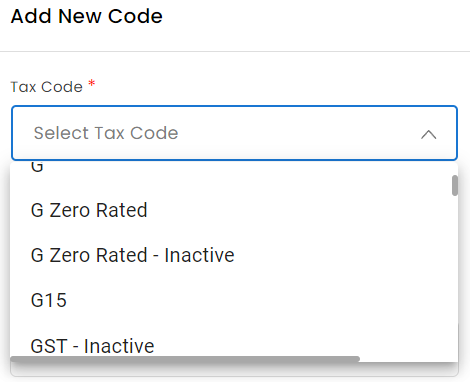

- On the right, click +Add New Code:

-

Select the appropriate code from the drop-down and fill the remaining fields:

What if my new tax code doesn't appear in the list?

You may need to refresh your drop downs. See this article for more information.

I use QuickBooks Canada. How do I map tax?

The process is the same as the U.S. tax codes. There is no need to map city or county. You can map a code, region, and enter CA as the country.

Can I import a spreadsheet of sales tax codes?

Yes, log into Connex and go to sales tax. Export a spreadsheet of tax codes. Add new ones. Click the upload button.

Do these tax codes affect one channel or all channels?

These tax codes will work on all sales channels in your account. If you go to settings and choose another account, the tax codes are identical. If you have two different company files, you should have two separate Connex accounts. If you require one tax code for Amazon and another for Shopify, for example, here are your options:

- Open a separate Connex account. Contact our sales team.

- If you use QuickBooks Canada, write a rule using map tax code on order items as the action. For more info, read this guide.

🔷 Next: Map Grouped Codes (Step 2)

![Connex_Logo_HelpCenter_100h.png]](https://help.connexecommerce.com/hs-fs/hubfs/Connex_Logo_HelpCenter_100h.png?height=50&name=Connex_Logo_HelpCenter_100h.png)