How does Connex for QuickBooks Desktop sync refunds?

Connex can sync refunds as credit memos or refund receipts. The credit memo setting is automatically turned on when a new connection is configured in Connex.

How does Connex for QuickBooks Desktop sync refunds?

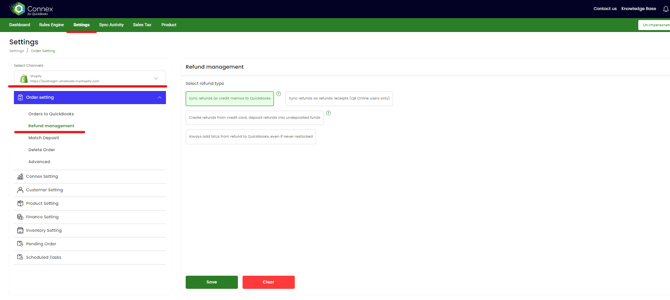

To access the Refund Management menu in the Connex account:

1. Login to Connex, click the Settings under Selling Channel.

2. Click Order Settings > Refund Management.

Credit Memo: If a customer has not yet paid, the credit memo will reduce what’s owed. If payment has already been made, the customer can either apply the credit to future purchases or request a refund. Connex will create a credit card refund and deposit the amount into undeposited funds. You can configure Connex to create a refund by check and use an asset account.

When a credit memo is created, QuickBooks will debit (lower) the revenue tied to the items you are refunding. Unlike a refund receipt, the system will credit (lower in this case) your accounts receivable, not your undeposited funds account.

Credit Card Refund: These refunds appear in undeposited funds. A refund receipt reflects a refund that you gave to a customer. In many cases, refund receipts will be used to document credit card refunds.

When a refund receipt is created, QuickBooks will debit (lower) the revenue tied to the items you are refunding. The system will also credit (also lower in this case) the bank account or undeposited funds account that is used for batching payments.

How should I match sales to deposits?

There are two ways to match deposits:

- All sales and refunds appear in the undeposited funds account. You can select the sales and refunds that match the deposit. This setting is enabled by default. If you have a low order volume and a single payment processor, then this is the recommend way to match deposits.

- You can deposit sales and refunds into separate asset accounts. You can create a deposit manually, instead of selecting several sales. This setting is ideal, if you have multiple payment processors. If you had Stripe, PayPal, and Authorize.NET, we recommend using different deposit accounts. For more info, read this guide.

![Connex_Logo_HelpCenter_100h.png]](https://help.connexecommerce.com/hs-fs/hubfs/Connex_Logo_HelpCenter_100h.png?height=50&name=Connex_Logo_HelpCenter_100h.png)