Getting Started with Sales Tax

How tax works with Connex

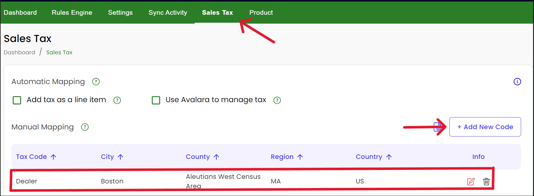

How do I map my QuickBooks Desktop tax codes?

You can map tax codes using the county, city, state, or country. You can say if the state is Massachusetts, then map MA as the QuickBooks tax code.

If your taxes are compound, like a city and country tax, Connex supports grouped tax codes. For more info, read this guide.

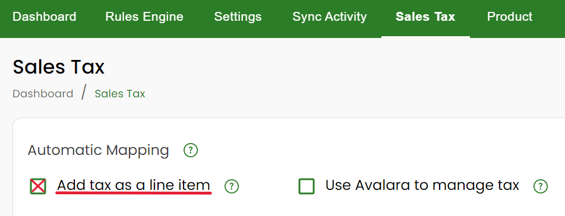

I do not use QuickBooks tax codes. How do I add tax?

You can add tax as a line item. For more info, read this guide.

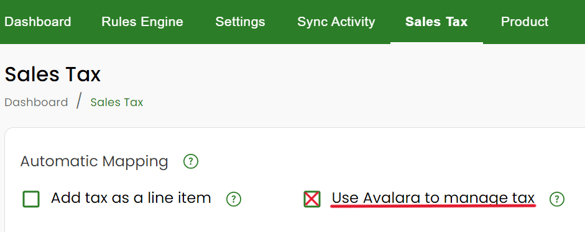

I use Avalara. How do I integrate it with QuickBooks?

Connex can map Avalara tax codes to QuickBooks. For more info, read this guide.

How does sales tax work with QuickBooks Online?

QuickBooks Online uses QuickBooks AST. Connex will send no tax and QuickBooks will apply the tax and rate. If you want to override the calculations, read this guide.

![Connex_Logo_HelpCenter_100h.png]](https://help.connexecommerce.com/hs-fs/hubfs/Connex_Logo_HelpCenter_100h.png?height=50&name=Connex_Logo_HelpCenter_100h.png)